Understanding your profit

“I’ve made all this profit – so where’s it gone?!”

Does this sound familiar? It’s probably the number one question we are asked and usually comes about when the tax needs to be paid.

In simple terms, profit is not what’s left over at the end of the day in your bank. That is cashflow. The two are not to be confused as the same thing.

Profit tells you how you are performing, but it is possible to manipulate it so it needs to be viewed along with other indicators to give a real understanding about business performance. For example, if you choose not to put on fertiliser this year and your profit goes up compared to last year, does that mean you are performing better? Not necessarily. If you turn another few paddocks into baleage and pay a contractor to do it, your costs go up and your profit goes down. Does that mean you are performing worse? Not if there’s a stack of supplementary feed sitting in the corner of the paddock for use in the winter.

Profit (with some adjustments) is also the amount the IRD look to levy tax on. They don’t levy tax on your cash surplus. If they did, they would never collect any taxes as I’m sure we would all look for ways to spend or invest it. Perhaps the best way to understand profit is by looking at a simplified rural financial business model.

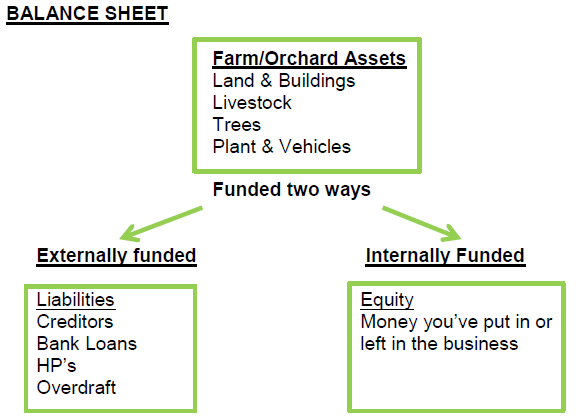

But first you need to understand what the balance sheet is all about.

Your assets are only funded in one of two ways. If they are funded externally they are called Liabilities. If they are funded internally, that’s Equity.

Equity is the balancing figure. It’s what would be left over if you sold all your assets and paid back all of your liabilities. The goal is to increase equity and reduce liabilities.

There are three ways to increase your equity:

- Inject your own money into the business

- Make profits and leave cash surpluses in the business to pay down liabilities or invest in assets

- Capital gains – eg: if your land value goes up $200,000 then that belongs to you now.

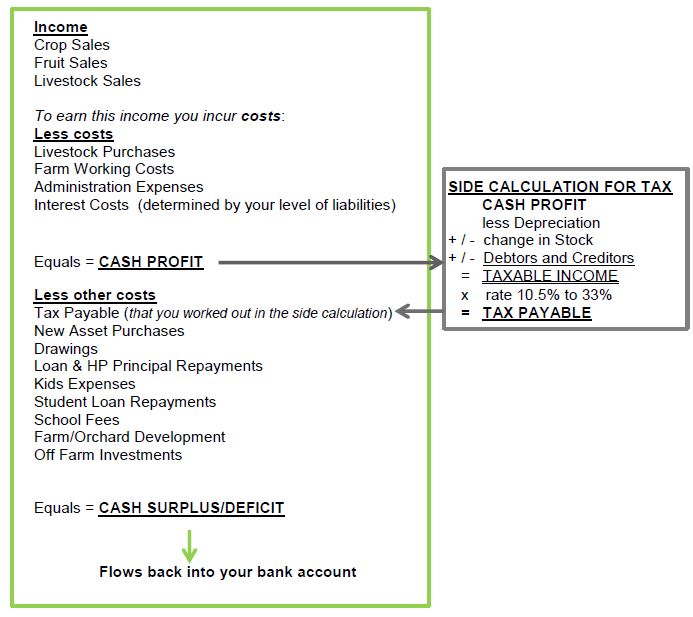

Your assets together with a labour contribution generate income.

Once you deduct costs from income, that gives you your Cash Profit

In a side calculation, the IRD adjust cash profit in three main ways to determine the income you pay tax on:

- Depreciation (basically representing a deterioration in your fixed asset value)

- Stock on hand adjustment

- Debtors/creditor adjustment (to bring in transactions that relate to the year but for cash purposes were received or paid outside the year)

Once these three adjustments are made, we have our Taxable Income. Depending on how you allocate it amongst the owners you will pay a rate somewhere between 10.5% and 33% of tax on this profit.

Going back to the cash profit, we then need to deduct a plethora of other costs.

What’s left over after all of these adjustments is cash surplus or deficit. If it’s a surplus, your bank account looks better than it did the same time last year. If it’s worse your bank account will obviously be worse off and next year your interest cost will go up, unless you inject more funds personally to cover the deficit.

That explains why tax profit is so different to cash profit and also explains why the IRD don’t levy tax on your cash profit.

The best way to plan for all of this, and to know where you are headed, is to do a budget. A budget incorporates all of this and tells you what is going to be left over at the end of the day. If you’re not happy with what it’s telling you, then now’s the opportunity to make a change. Leaving it until the end of the year is obviously too late.

If you want help with your budgeting, then get in contact with us. We have developed a budgeting service to help you plan for the year ahead. You’ll feel more in control of your business if you do some planning at the start of the year.