Cash Manager Rural Tips and Tricks

Closing Livestock Tallies

Closing Livestock Tallies

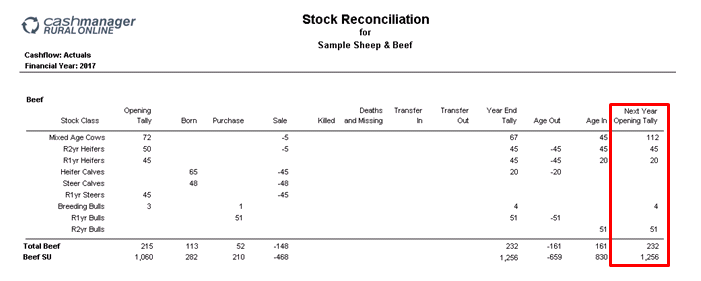

Before submitting your financial year end questionnaire please check that your Livestock Year End Tally is correct.

From the Transaction screen click on Reports – Accountants Livestock Rec.

Livestock tallies do matter so please be careful that the stock transactions (sales and purchases) have been coded correctly and that tallies have been recorded. Check that your Year End Tally agrees to what you have on your farm at balance date. If you want to brush up on your livestock reconciliation skills, then refer to our previous article here.

Don’t close off your 2019 financial year just yet

Please hold off from closing your 2019 Financial year in Cash Manager Rural until we have completed your financials. This is to ensure that transactions can still be edited for coding corrections or to include accounts payable and receivable.

Dwelling expenses claim

Have you updated your farm dwelling expenses claim? We have noticed a few clients are still using the old rules. There is no longer the ability to claim a straight 25% on your dwelling costs. From 1st April 2017 the rules were changed by the IRD and your allowable claim depends on whether you are a Type 1 or a Type 2 farm. If you are unsure what your dwelling claim should be, please refer to our previous article here.